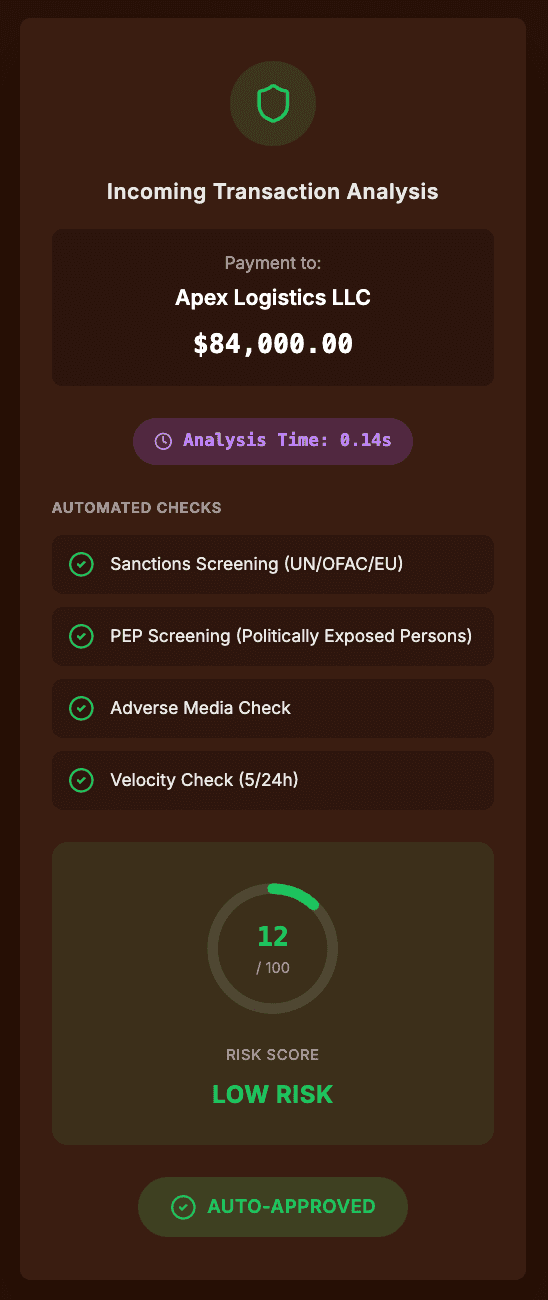

Bank-Grade Compliance (0.14s Screening)

Automated compliance in 0.14 seconds—not 24-48 hours

Every payment is automatically screened against UN/OFAC/EU sanctions, PEP databases, and adverse media in under 0.14 seconds. Bank-grade security with full audit trails for regulators. We handle compliance so you can focus on business.

How It Works

Payment Initiated

When you or your team initiate a payment, our compliance engine activates immediately—before the transaction is processed.

Multi-Database Screening

In 0.14 seconds, we check: UN Consolidated List, OFAC SDN, EU Sanctions, UK HMT, PEP databases, and adverse media sources.

Risk Assessment

AI analyzes screening results, transaction patterns, and beneficiary history. Low-risk payments proceed instantly; flagged items route to review.

Audit Trail

Every check is logged with timestamp, data sources, and decision rationale. Full audit trail available for regulators and internal compliance.

Key Benefits

Real-World Use Cases

High-Volume Payment Operations

Process 50 payments daily without compliance delays. Each screens in 0.14s, so your entire payment run completes in under a minute—not days.

New Supplier Onboarding

Add a new Chinese supplier. Instant screening checks their entity, directors, and ownership against all sanctions lists. Approval or flag in seconds.

Regulatory Audit

FCA audit requests payment compliance records. Export complete audit trails showing every check, timestamp, and decision for any date range.

Unicorn vs Traditional Banks

| Aspect | Unicorn Currencies | Traditional Banks |

|---|---|---|

| Screening Time | 0.14 seconds | 24-48 hours |

| Coverage | UN, OFAC, EU, UK, PEP, Adverse Media | Varies—often incomplete |

| Audit Trail | Complete, exportable | Limited visibility |

| False Positive Handling | AI-assisted review | Manual review queues |

Frequently Asked Questions

How fast is compliance screening?

Every payment screens in 0.14 seconds on average. This includes checks against UN, OFAC, EU, and UK sanctions lists, plus PEP databases and adverse media sources. Low-risk payments proceed instantly.

What sanctions lists do you screen against?

We screen against UN Consolidated List, US OFAC SDN and SSI, EU Consolidated List, UK HMT, and additional regional sanctions lists. Coverage is updated in real-time as lists change.

What happens if a payment is flagged?

Flagged payments route to your compliance review queue with full context: why it was flagged, matching entity details, and recommended action. You can approve, reject, or request additional documentation.

Do you provide audit trails for regulators?

Yes. Every screening check is logged with timestamp, data sources checked, matching results, and decision rationale. Export complete audit trails for any date range for regulatory examinations.

Is ongoing monitoring included?

Yes. We don't just screen at payment time—we continuously monitor your beneficiaries and counterparties. If someone gets added to a sanctions list, you're alerted immediately.

See Compliance In Action

Request a 15-minute demo. We'll show you how compliance works with your actual invoices and suppliers.

For businesses with $1M+ annual FX volume. Not consumer transfers.