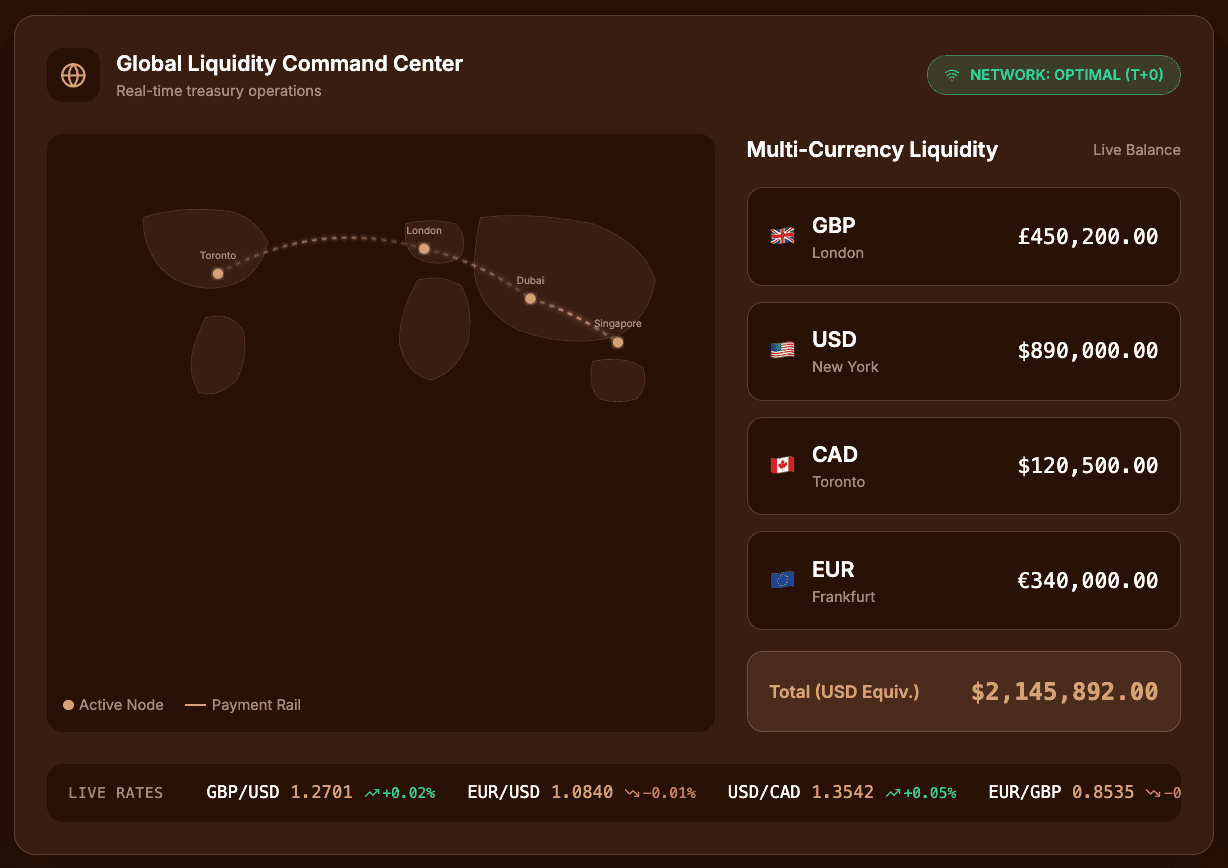

Multi-Currency Wallets

Hold 20+ currencies with unique banking details for each

Hold GBP, USD, EUR, AED and 20+ other currencies in separate wallets, each with unique banking details (IBAN, SWIFT, Sort Code). Instant conversions between currencies with real-time balance tracking and no monthly fees.

How It Works

Open Currency Wallets

Activate any of 20+ currency wallets with one click. Each wallet gets unique banking details—your own IBAN, account number, or routing details for that currency.

Receive Payments

Share your wallet details with customers. They pay you in their local currency (EUR, USD, etc.) directly into your wallet. No conversion loss on receipt.

Hold or Convert

Hold funds in any currency until rates are favorable. Convert between wallets instantly at 0.5% spread when you choose.

Pay Suppliers

Pay suppliers directly from the matching currency wallet. No FX needed if you hold their currency—zero spread on same-currency payments.

Key Benefits

Real-World Use Cases

Import/Export Currency Matching

You export to the EU (receive EUR) and import from China (pay CNY). Hold EUR until favorable CNY rate, then convert. No double conversion loss.

Multi-Region Supplier Network

Pay suppliers in India (INR), Turkey (TRY), and Vietnam (VND). Hold each currency and pay directly—no conversion needed for routine payments.

Customer Payment Collection

US customer pays your USD wallet directly. No 3% bank conversion on receipt. Convert to GBP when rates suit you.

Unicorn vs Traditional Banks

| Aspect | Unicorn Currencies | Traditional Banks |

|---|---|---|

| Currencies | 20+ with unique details each | Limited multi-currency |

| Monthly Fees | £0 | £20-50/currency |

| Conversion Speed | Instant | 1-2 business days |

| Minimum Balance | None | Often required |

Frequently Asked Questions

How many currencies can I hold?

You can activate wallets in 20+ currencies including GBP, EUR, USD, AED, CNY, INR, JPY, AUD, CAD, CHF, SGD, HKD, and more. Each wallet has its own unique banking details.

Do I get my own account numbers?

Yes. Each currency wallet has unique banking details—IBAN for EUR, sort code and account for GBP, routing and account for USD, etc. Share these details with customers for direct payment.

Are there fees for holding multiple currencies?

No monthly fees, no minimum balances, no inactivity charges. Hold as many currencies as you need for as long as you need. You only pay 0.5% spread when converting between currencies.

How fast are conversions between wallets?

Instant. Click convert, lock the rate for 15 seconds, confirm, and funds move between wallets immediately. Real-time balance updates show the transfer.

Can customers pay directly into my wallets?

Yes. Share your EUR wallet details with EU customers, USD details with US customers, etc. They pay in their local currency, you receive the full amount with no incoming wire fees.

See Multi-Currency Wallets In Action

Request a 15-minute demo. We'll show you how multi-currency wallets works with your actual invoices and suppliers.

For businesses with $1M+ annual FX volume. Not consumer transfers.